Car Loan Calculator

A car loan is a type of loan that an individual secures from a financial institution like a bank for purchasing a car. Today, everyone has a car and truth be told, it has become a necessary personal asset in today’s hectic and fast-paced lifestyle. You can consider buying a first-hand car or a used one; whatever fits your budget. It would all depend on your needs. You can repay the loan in the form of EMIs.

If you default on the loan, your credit score will take a hit; in the worst-case scenario, the lender could end up seizing your car to compensate for their loss. The good part is that today, banks offer car loans at affordable interest rates and tenures so that you don’t have to go that extra mile and stretch your budget. The car loan EMI is made up of the principal and interest portion of the loan. The EMI would remain a fixed amount and will be paid in the form of instalments on a monthly basis.

Want to determine the exact number of monthly installments of your car loan? Then a Car Loan EMI calculator is what you need. By using a Car Loan EMI calculator, you can easily know the amount which you must borrow along with the interest rate as well as the Car Loan EMIs. All you need to do is fill in the loan amount, tenure, and the interest rate. As you enter these details, the EMI amount will reflect in front of your respective screen.

(Principal + Interest)

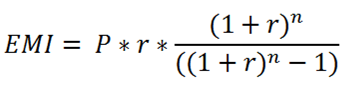

Here's the formula to calculate the Car Loan EMI:

Where

E is EMI

P is Principal Loan Amount

N Loan tenure in months

R Monthly interest rate

The rate of interest (R) on your loan is calculated per month.

R = Annual Rate of interest/12/100

For example : you take a car loan of Rs 5 lakh at an interest rate of 12%, the approximate EMI will be

EMI = ₹5,00,000 * 12/100/12 * (1+12/100/12)24 / (1+12/100/1224 - 1)

= ₹23,537.

How to use Car Loan EMI Calculator?

- Enter the loan amount

- Select the number of months using the slider

- Select the interest rate using the slider

- You will get the EMI Payable, Total interest payable along with the Total Payable Amount

- If you want then you can easily recalculate the amount, all you need to do is change the amount in the sliders

Benefits of Car Loan EMI Calculator

- You get clarity on the EMI amount that you would be paying the lender.

- It also helps you get your finances in order.

- There is no need to do complex calculations as the calculator’s software does that for you.

- It also helps you get a fair idea of the tenure you will have to pay the EMIs for, the shorter the duration the higher the amount of the EMI and the longer the duration, the lesser the amount of the EMI

Frequently Asked Questions

-

How does the duration of the EMIs affect the amount of interest?It is very important to know that your interest rate is not the only parameter which will be determining the total amount of interest you will need to pay on your car loan. The car loan tenure also plays a significant role in determining the amount of interest you pay to your lender.

-

What are the current interest rates for car loans?Currently, the banks are offering interest rates between 8.5%-12%. Several banks often tend to relax their rates and even completely waive off their processing fee during the festive season. The end consumer also needs to understand that their credit history also plays a major role while you negotiate on the interest rates. With a higher credit score, you can easily bargain for a lower interest rate.

-

Out of Car Loan EMI Calculator and Excel Calculator which one is better?The Car Loan EMI Calculator is specifically made to calculate the EMIs for car loan. Plus, it is way easier to use as compared to an Excel calculator.

-

Can there be a difference between Car Loan EMI that’s calculated by the bank and which is calculated by an EMI calculator?No, it will be the same always given the fact that values entered were the same.

-

Can the Car Loan EMI Calculator help me navigate and understand how much EMI would be payable after paying a certain principal amount?Yes, all you have to do is enter the details of the outstanding balance along with the loan tenure.

-

Is the car loan calculator the same as home, personal loan calculator?These calculators are fundamentally the same. However, the Car Loan EMI is designed to give you information as per your car loan.