What is PAN Card?

The permanent account number is the full form of a PAN Card. It is a 10-digit number consist of both alphabets and numeric terms. The main responsibility of allotting the PAN card is on the NSDL and UTIITSL to all those individuals whose annual earnings fall under the taxation slab of India. Apart from tracking the taxpayer’s financial activities, PAN Card makes it easier for Income Tax authorities to track the financial activities of India.

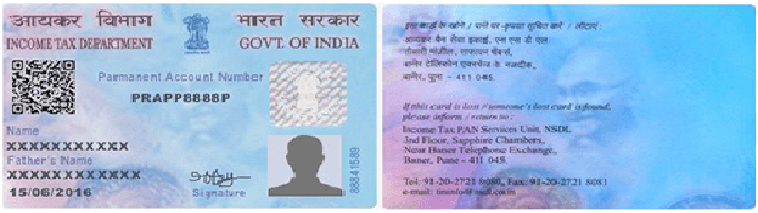

A PAN number is printed on a laminated card having details like PAN number, name, Date of birth, and address. The PAN allotted to each individual is different. No two people could be given the same PAN number.

Pan Card structure

- The Income Tax department of India has updated the design of the PAN card on January 01, 2017.They have added the feature of the ‘QR’ code. It helps with data verification.

- Along with the name of the PAN cardholder, it added Father’s name and date of birth also.

PAN authorities also made some changes in the location of the signature of the PAN Cardholder.

What is the significance of the PAN Card in India?

- For filing Income Tax return of India

- For filing a loan application and getting quick approval on the same, it is a must to submit PAN details. It is made compulsory by every bank and financial institution to submit PAN Card to get a loan application approved be it a secured loan, or an unsecured loan.

- For opening a bank account be it a saving account, current account, or joint account, it is a must to have a PAN card.

- If you are making a cash deposit of above Rs 50,000, it is a must to submit PAN details as per the RBI rules.

- If you are making a fixed deposit of above 50,000, then also you are required to share PAN Card details. All the fixed deposits which are above Rs 50,000 become liable for TDS deduction by the bank on interest earned.

- At the time of doing a foreign exchange, a PAN card is compulsory be it is done with banks, financial institutions, or money exchange bureaus.

- If you are buying a life insurance policy, whose annual premium exceeds Rs 50,000, Pan Card is compulsory.

- When you are applying for government identity proof, you are required to submit PAN details.

- If you have purchased a vehicle or jewelry having worth more than 500,000, you are required to submit PAN details

Types of PAN Card

- PAN card for Individual: One can apply by filling out Form 49A which is available on the website of NSDL and UTIITSL. Here the individual includes resident Indians, minor, or students

- PAN Card for a company: Firms and corporate entities operational and registered in India are also liable to apply for a PAN Card. They require a PAN card for making financial and tax-related transactions.

- PAN Card for NRIs: There requires a PAN card if they are earning from India. NRIs are required to fill Form 49AA

- PAN Card for NRE and OCI: The non-resident entities and Overseas Citizen of India apply for a PAN card using Form 49AA

PAN Card eligibility

According to the clauses of the Income Tax Act, Indian residents under the following categories are eligible for PAN Card registration:

- People who are liable to pay tax to the Income Tax Department of India

- Self-employed or Businessmen who are earning an annual turnover of 5 Lakh or above

- To carry out export and import activities

- Registered Trusts, organizations, and associations.

Documents required to apply for a PAN Card:

To get enrolled for a PAN card, the main documents required be it the application is made offline or online.

- Voter ID card,

- Passport

- Aadhaar Card

- Driving License

Ways to file PAN Card application

Pan card applying through online mode

- You can apply for PAN Card by log on to the website of NSDL or UTIITSL

- After that select, the option of ‘ Apply for PAN Card online

- Select the category like individual, company, partnership firms, or NRI

- Choose the form 49A or 49AA as per the category

- Mention the details like first name, date of birth, last name, contact details, email address, and middle name on your PAN Card application

- Attached the required documents to apply for a Pan card

- After submission of the PAN card application, the website provides you with a 15-digit acknowledgment number, and please take the printout of the page for your records.

Pan card applying through offline mode

- You can download the form from the NSDL or UTIITSL website and fill in the details like first name, date of birth, last name, contact details, email address, and middle name on your PAN Card application.

- Attached the required documents to apply for a PAN Card.

- Post the application at the mentioned address

- INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance, Infrastructure Limited)

- 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune - 411 016.

Please note that the PAN card application for new and reissue of PAN card is different. Once the user makes any of the above PAN card applications then he or she can easily track the status of PAN with the help of acknowledgment number furnished by NSDL or UTIITSL after making submission of the PAN application.

Pan Card

-

Duplicate Pan Card

-

Pan Form 61

-

Chang of name Pancard after Marriage

-

Pan-Card-with-Paytm-Payment-Bank

-

Surrender-your-Pan-Card

-

Lost Pan Card

-

Pan Card for HRA Exemption

-

Bulk Pan Verification

-

Pan form 49A

-

Pan Form 49AA

-

What is form 60

-

What is Form 61A

-

How to Apply Pan Card

-

Pan Card Postal Address

-

Change Photo and signature in Pan Card

-

How-to-Check-TDS-Status-via-Pan Card

-

Get-Pan-Card-in-48-Hours

-

Get-Pan-Card-Through-Aadhaar-Card

-

Link-Pan-Card-with-Aadhaar-Card

-

Link Pan Card With EPF Account

-

how-to-track pan card Delivery Status

-

Pan-Card application for students

-

Pan-Card-Ackowledgement-Number

-

Change your pan address

-

Cancel Your Pan-card

-

Pan Card Corrections

-

Pan Card Charges

-

Pan Card for Minors

-

Pan card for NRI

-

Pan Card For Partnership Firms

-

Pan Card Jurisdiction

-

Pancard-Penalty

-

Pan Card reason for rejections

-

Required document for Pancard

-

Significance-of-Pan-kyc

-

Get Pan Card Details

-

What is Pan Card