Home Loan EMI Calculator

Home Loan Calculator is a financial tool that helps you calculate your Home Loan EMI without hassle. The objective of a Home Loan Calculator is to help you make an informed decision about loan amount to be applied for if buying a new house so that your home loan doesn’t become heavy on your pocket. It helps you in planning your home loan EMIs

(Principal + Interest)

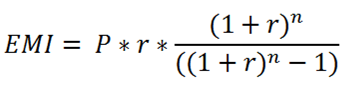

Here's the formula to calculate the Home Loan EMI:

Where

E is EMI

P is Principal Loan Amount

N Loan tenure in months

R Monthly interest rate

The rate of interest (R) on your loan is calculated per month.

R = Annual Rate of interest/12/100

For example : If a person avails a loan of ₹5,00,000 at an annual interest rate of 7.2% for a tenure of 120 months (10 years), then his EMI will be calculated as under:

EMI = ₹5,00,000 *&0.006 * (1 + 0.006)120 / ((1 + 0.006)120 - 1)

&&&&&& = ₹5,811

How to use Home Loan EMI Calculator?

- Use the slider for selecting the loan amount.

- After that select the loan tenure in month format.

- Move the slider and select the rate of interest.

- The calculator will show you the EMI payable, Total interest, and Total Payable Amount.

- Recalculate your EMI anytime by changing the input sliders.

- EMI will be calculated instantly when you move your sliders.

Benefits of Home Loan EMI Calculator

- It’s simple and convenient to use

- There is no way you can go wrong with numbers especially when it’s about your home.

- Thus, a Home Loan EMI Calculator comes as a handy and very useful tool to be used.

- It’s fast

- Using a pen and paper, you will end up wasting hours and even then the right figure isn’t guaranteed.

- However, with the Home Loan EMI Calculator, you are guaranteed the results.

- It helps in financial planning

- It is a great way to plan your Home buying budget in an efficient manner without any kind of discrepancy.

Frequently Asked Questions

-

What is Home Loan EMI?A home loan is one of the biggest loans anyone can take in the present economic conditions. So, you take a home loan for a longer period of time due to its huge financial value. And when you take a loan from a financial institution like a bank, it charges you with a certain interest rate for a specific tenure of time which is called the Home Loan EMI.

-

What is a pre-approved Home Loan?Fundamentally, a pre-approved home loan is an approval for a loan given on the basis of your income, financial position and creditworthiness.

-

When will my Home Loan EMI start?Your home loan EMI will begin from the month after the month in which the disbursement of your loan would have been done.

-

How do I repay my Home Loan?You can pay back your home loan via post-dated cheques or via ECS which is known as the Electronic Clearing System from your account.

-

Can I get approval for my home loan while I decide which property I should purchase?Yes, you can do that. Usually, pre-approved home loans are taken before the property selection and are considered valid for six months from the sanction date.