Rent Receipt Generator

If you are a salaried employee, you are mandated to make a submission of rent receipt in accordance with Income Tax Act, 1961. Through rent receipts, you can claim tax exemptions. The rent you are paying from your earnings for the whole financial year gets deducted from your annual earnings.

A rent receipt is a documentary record of rent payment. It is proof that the tenant has paid his rent to the landlord. This rent receipt is signed by the landlord after collecting the rent. This rent receipt is accepted by the Income Tax Department for HRA in tax benefits. The rent receipt is considered as legal proof of the rent payment in case of any misunderstanding between the landlord and tenant.

Generate a Rent Receipt Online

------How It Works?------

-

Form Fill

-

Generate & Pay

-

Choose Your Format & download

Steps to generator a Rent Receipt Online :

- Step 1:

- Rent details:

Enter the column provided in the rent details such as property type, monthly rent amount, receipt frequency, rent collected, mention the advance amount paid to the landlord, monthly maintenance amount, and mention who is preparing the rent receipt. tenant details, tenant address, and owner details.

- Rent details:

- Step 2:

- Tenant details:

In this section, the tenant has to provide their details in the given column such as the tenant's full name, tenant e-mail ID, and mobile number of the tenant.

- Tenant details:

- Step 3:

- Tenant Address:

Enter the door no, flat no, name of the premises/building, street or road or lane name, village or area or locality or taluka or sub-division name, state or union territory, town or city or district, pin code, and country name.

- Tenant Address:

- Step 4:

- Owner details:

Enter the house or building owner's name, PAN number, and mobile number.

- Owner details:

- Step 5:

- After filling the column, click the Generate Receipt column given below in blue. Now you can download the form and take printouts.

The landlord and tenant can visit our rent receipt generator facility on localitydetails.com, in a simple format. On our localitydetails.com portal, fill in the given column provided in the following details.

Important components of Rent Receipt

- Tenant name

- Rent Paid

- Landlord Name

- Rental Period

- House address

- Signature of Landlord

How does the Rent Receipt Generator work?

- The Rent Receipt Calculator is an easy-to-use financial tool that allows you to create receipts you have paid during the whole financial year.

- The receipts that are generated with the help of this financial tool are as per the format specified by the Income Tax Authorities. One can take a printout of the same as per convenience.

Why is it necessary for rent receipts?

A valid rent receipt is a document for claiming house rent allowance (HRA), which is legally accepted by the Income Tax Department. To avail of HRA, a rent receipt has to be submitted to Income Tax after it was signed by the receiver (the landlord). Nowadays, rent payment is made through online transactions through credit card or online money transferring mode. But, it is necessary to submit proof of rent receipt, so collect rent receipts from your landlord to claim HRA deductions.

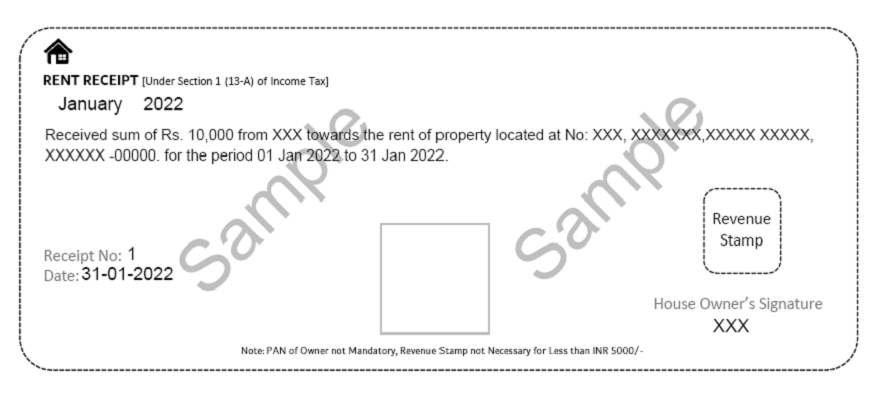

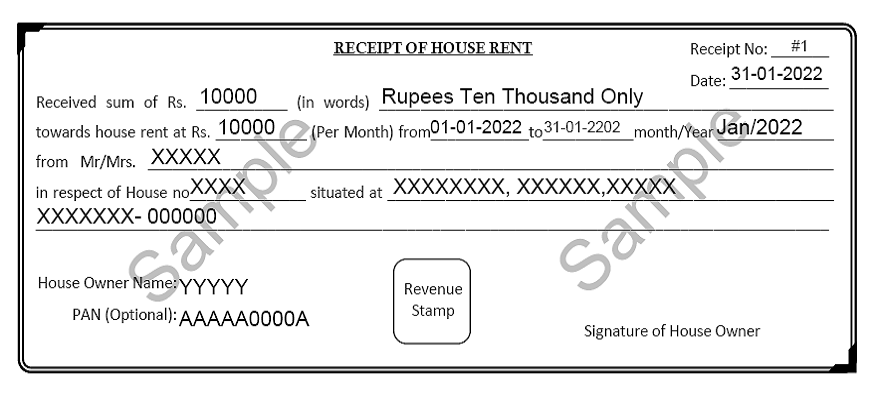

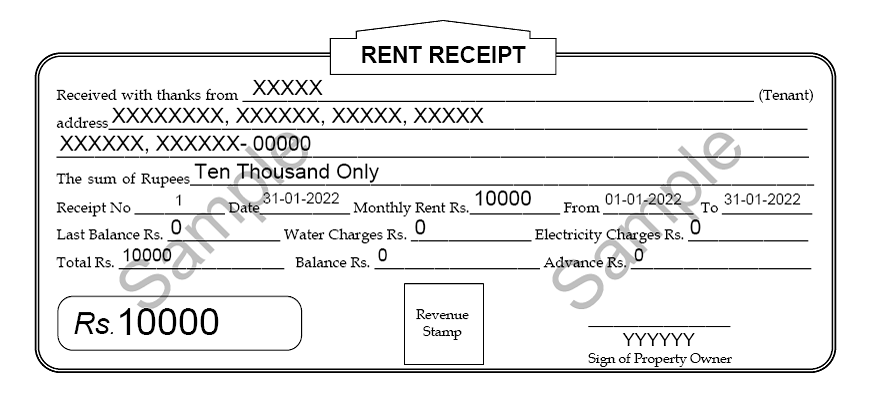

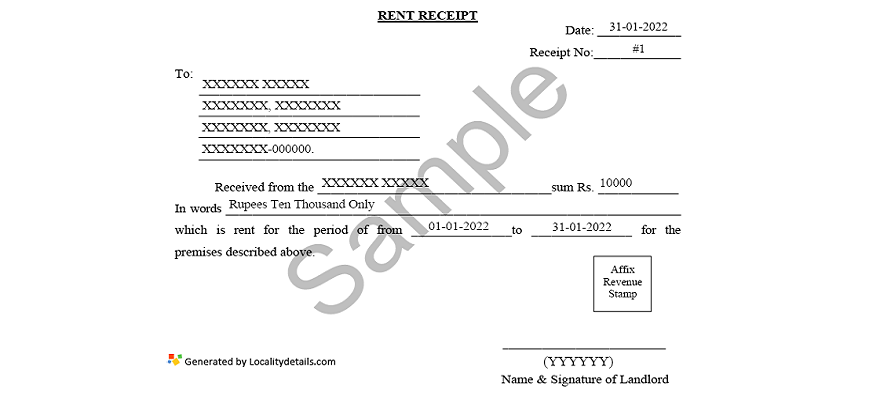

components of a rent receipt

- In order to make a rent receipt valid, it must contain certain details such as the name of the landlord, name of the tenant, address of the occupied property, rent amount, rent period, medium of payment made to the landlord (cash, cheque, online payment), the signature of the tenant, the signature of the landlord, revenue stamp, PAN number of landlord, etc.

- This rent receipt with a revenue stamp is prepared for those who pay more than Rs.5,000 per month for a house and mention the PAN details of the landlord when the payment exceeds Rs. One lakh or Rs.8,350 monthly. It is very important that any missing information in the rent receipt would make them invalid or null.

Tax Benefits :

There are provisions in the Income Tax Department under which House Rent Allowance (HRA) could be claimed by an individual. Any salaried individuals living in rented accommodation for various reasons can avail of HRA exemption and save tax under Section 10 (13A) of the Income Tax Act. The self-employed professionals are also availing of the offer of HRA tax deduction under Section 80GG of the law.

Extent Of Tax Benefits

Importance of rent receipts

- All annual income earned by an individual in India more than the allowed or permissible limit is taxable under the income tax law. The individual earnings by salary, business profit, professional, or other income are liable to pay taxes.

- On the other hand, the law is also allowing a few deductions against the expenses made towards specific instruments. Anyone who spends a portion of their annual income as rent payments is also eligible to claim deductions under various sections of the tax law.

- In order to get a rent payment allowance from Income Tax it must have proof of the documents by making these payments valid. Providing proper house rent receipts or rent slips as per the requirement of Income Tax is qualified for House Rent Allowance (HRA).

- The salaried individual has to submit this rent receipt to their company's HR department before filing or submitting it with Income Tax. If this rent receipt is not submitted with Income Tax, then it is not considered for HRA.

Frequently Asked Questions

-

Is it necessary to have a revenue stamp on rent receipt?A revenue stamp must be on rent receipts, only then that receipt is considered valid. If you are paying rent through cheque, only then rent receipt is not considered valid.

- If you are paying rent in cash up to Rs 50,000, a revenue stamp is not required.

- If you are paying cash more than Rs 50,000 per receipt, then a revenue stamp is required.

-

Do I need to share the rent receipt with my employer every month?No, usually employers ask to share the rent receipt for the last 4-6 months.

-

What is the best way of generating monthly rent receipts?To generate rent receipt, you need to be aware of the tenure for which you are looking to generate receipts. One can generate receipts monthly, yearly, or quarterly.

-

Will revenue stamps also come along with e-receipt?No, the revenue stamps you paste on your receipt manually. Online you can generate receipts only.

-

What is needed for claiming HRA?As an employee, if you want to claim HRA, you must have a stamped rent receipt given to you by your landlord.

-

Can I claim tax exemption without showing a rent receipt?If an employee is getting HRA above Rs 3000, it is a must for them to share the rent receipt. Below, Rs 3000, it is not required.

-

What should I do, if my landlord does not have a PAN?If the tenant is paying more than Rs.One lakh as annual rent, but the landlord does not have a PAN. The tenant can get a written declaration from him along with duly filled Form 60. The tenant can submit these proofs of the document to the employer or Income Tax to claim HRA deductions.

-

Is paying house rent online possible?Yes, the tenant can pay their rent online by getting the details of the landlord. Once the money is transferred don’t forget to get the signature on the rent receipt from him. The tenant's payment history is also considered proof of rent payment.

-

What happens if I pay rent using my credit card?The tenants can pay their monthly rent using their credit card to the landlord’s bank account with the help of the IFSC code. Once the money is transferred to the landlord's account, the tenant can get a signature from the landlord on the rent receipt over the affixed revenue stamp.

-

With whom should I share the details of the rent payment?You have to share the rent payment details with your employer before submitting it to the Income Tax Department.