Fixed Deposit Calculator

The Fixed Deposit calculator is one safest and most widely used instruments in India. It is the need and necessity of everyone whosoever is planning to invest in FD schemes. Online there are many financial institutions available that offer you the flexibility of using an FD calculator free of cost online. The main reason for the increasing popularity of the FD calculator is that it helps you analyze the interest and maturity amount based on the investment.

It takes into consideration the principal amount, applicable rate of interest, and tenure to calculate the maturity amount at the end. So, before you invest in a fixed deposit, this calculator gives you an idea of your earnings in advance, thus helping you make a wise financial decision.

How Fixed Deposit Calculator works?

You can use the FD maturity calculator easily, there is no rocket science. All you need to do is click on the Fixed deposit calculator online and choose the type of investment, tenure, and principal amount. Once you share the data in the fixed deposit interest calculator, you will know the total maturity amount, and the interest you earn on principal will be automatically displayed.

Here's the formula to calculate the Fixed Deposit :

There are two ways of calculating interest on Fixed Deposit Calculator :

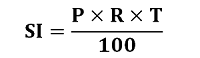

1 . Simple Interest :

Where

SI is Simple interest

P is Principal Loan Amount

R is Rate of interest

T is Tenure of the fixed deposit

For example : Let's assume, you are spending Rs 30,000 for 5 years at an interest rate of 10%

=> 30000x5x10/100

= > Rs 15000

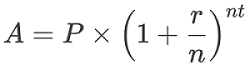

2 . Compound Interest :

Where

A is Maturity Amount P is Principal Loan Amount

n number of compounding in a year

r is Rate of interest (in decimals)

t is number of years

For example : Suppose Invested Rs 15000 for 3 years at the rate of 10%

=> 10,000 [1+ (0.10/4)] ^ (4*3)

=> 10,000 (1.025) ^ (12)

=> ₹13,449 (approximately)

Benefits of using Fixed Deposit calculator

- FD investment becomes easier and transparent with the help of an FD calculator as it requires minimal effort, and you no more have to do manual calculations. You get to know the interest earned in a matter of few seconds.

- Saves time and effort since you get results in seconds.

- It is accurate, results are error-free

- Due to the accuracy of the FD Calculator, you will be able to plan your finances better.

Frequently Asked Questions

-

How many times in a day I can use FD calculatorFundamentally speaking, compound interest is an interest on a loan calculated on both the initial principal interest and the accumulated interest from the previous period.

-

Is this FD calculator available for mobile browsers also?Yes, Fixed Deposit Calculator is available for mobile browsers also, you download the app also of the financial institution, and can use the same.

-

How many FD scheme interest rate calculations can be done at a time of using FD calculator?You can make calculations of the interest rate of only 1 FD scheme while using FD calculator.

-

What documents are required to furnish while using FD calculator?There are no documents required to use FD calculator, all is required to furnish principal amount value, tenure, and interest rate.

-

What is the minimum tenure in Fixed Deposit investment?The minimum tenure in FD investment is 7 days