Gratuity Calculator

Being a salaried employee, if you worked with the company, minimum for 5 years, as per the Payment Gratuity Act of 1972, you become liable for gratuity. It is also known as a gratuity amount. The gratuity never reflects on your salary amount. It is settled when you leave or taken an exit from the company.

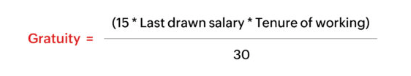

Here's the formula to calculate the Simple Interest :

Where

n is Tenure of service completed in the company

b is (Last drawn basic salary + dearness allowance)

For example : , if you have worked for a company for seven years, the organization is not covered under the Gratuity Act. And your basic salary was Rs. 35,000.

Gratuity Amount = (15 × 35,000 × 7) / 30 => 1,22,500.

How gratuity calculator helps you in getting the right calculator amount?

A gratuity calculator helps in determining the gratuity amount you are liable to receive. It works both for employer and employee as well. We all know that gratuity amount calculation manually is a tedious process, but with the help of an online gratuity calculator, you can get quick results, just with a click of the mouse. Online, there are many financial institutions available where you can use a gratuity calculator free of cost and anytime you want. The best part about the gratuity calculator is that apart from the employer, you can also calculate your gratuity. The chance of error becomes less.

What are the eligibility criteria for Gratuity?

- The employee must be eligible for superannuation.

- You must have completed 5 years of service in the same company.

- In case of an employee ‘s death, the gratuity is credited to the nominee’s account

Benefits of Gratuity Calculator

- A gratuity calculator helps you determine the exact amount the employer has to give you for giving service to the company.

- The calculator saves the hassle of manual calculation.

- You can use the gratuity amount as many times as you want and use multiple combinations.

How does Gratuity Calculator work?

- When service of 5 years completed

- Enter the basic monthly salary and dearness allowance in your respective field.

- Fill in the joining date for calculating the number of working years in the firm.

- Once you fill in the details, you will get the exact gratuity amount in seconds.

- You can find out the gratuity amount adjusted against different inflation rates by selecting different toggle options.

How gratuity calculator helps you in getting the right calculator amount?

The amount of gratuity received by any government employee (whether central/state/local authority) gets exemption from Income Tax. If you are a private employee whose employer is covered under the Payment of Gratuity Act, there are three amounts of getting tax exemptions. For example, your employer had paid you a gratuity of Rs 12 lakh. As per the gratuity calculation in the earlier example, you are eligible for a gratuity amount of Rs 2,59,615. The government has kept Rs 20 lakh, the upper tax-free limit. The lowest of the three figures is Rs 2,59,615, which gets tax exemptions. It is mandated to pay tax on the remaining amount of Rs 9,40,385 as per your income tax slab.

Frequently Asked Questions

-

What if I served only 4.5 years in the same company? Would I be eligible for Gratuity?No, as per the payment gratuity act, you are only liable for gratuity amount, if you complete 5 years of tenure in the same company.

-

Do a contractual employee available for a gratuity amount?If an individual is on the payroll of the company, he or she is considered an employee of the firm and liable for gratuity. But if the employee is on the payroll of the contractor, then that contractor has to pay gratuity

-

What happens to my gratuity amount if my employer goes bankrupt?You are liable for the gratuity amount, even if your employer goes bankrupt. The employer even goes bankrupt and has to clear all the dues of employees.