Lumpsum Calculator

This calculator is also known as mutual fund lumpsum calculator. If you are thinking of making lumpsum investment, then calculate the future value of wealth using lumpsum calculator. For instance, you are likely to invest Rs 1 lakh rupees for 60 years at 15%, then as per lumpsum calculator, your savings will be 48.3 Cr approx. after 60 years.

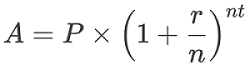

Here's the formula to calculate the Lumpsum :

The Lumpsum mutual fund investment amount depends on the market inflations. The formula used by the lumpsum calculator is

Where

P The current value of the invested amount

A Denotes estimated return

n the number of times interest is compounded in a year

r is the estimated rate of return (in %)

t Duration of investment

For example : Planning to invest Rs 50,000 in a mutual fund for 7 years at 12 % rate of interest. The formula for the same will be

A = ₹50,000 {(1+00.12/1) ^7}

A = ₹50,000 x 2.2107

A = ₹1,10,535

How Lumpsum calculator work?

The mutual fund lumpsum calculator is an automated tool that simplifies all the complicated Math. The major details required are:

- Quantum of the investment

- Tenure

- Expected rate of return

Benefits of Lumpsum Calculator

- This calculator is easy to use

- Show your estimated value of investment within seconds. You will get quick results

- A handy tool to analyze whether you can reach your financial goal with a specific mutual fund investment.

- Use an online lumpsum calculator to estimate the value of investing in different mutual funds, and then choose one that meets your needs.

Frequently Asked Questions

-

How does Lumpsum calculator works?The online lumpsum calculator uses a specific formula for computing estimated returns on investment. It works on compound interest formula.

-

Is making lumpsum investment is good for long term?As per investment experts, one-time lumpsum investment in mutual funds is never a good option. It is being said it is quite of weak markets, where if an investor is investing, must invest smartly and get higher return in long term.

-

Are lumpsum investments taxable?Yes, mandatory income tax withholding of 20 % applies to most taxable distributions paid directly to you in a lumpsum from employer retirement plans.

-

What do you understand by Mutual Fund Lumpsum investment?When you are investing money in mutual fund as a one time, it is known as Mutual fund lumpsum investment

-

How does Mutual fund lumpsum calculator offers you wealth gain?The online mutual fund lumpsum calculator helps in estimating the value of investment based on your investment amount, duration, and expected rate of return. The wealth gain will be displayed as difference between future value and initial value of investment.