Mortgage Calculator

A mortgage calculator is a very useful tool that helps you calculate the EMIs you must pay to your lender every month against your property loan. It is super easy to calculate the EMI amount with a Mortgage calculator, all you need to do is enter the loan amount, the rate of interest and the tenure of the loan and in seconds you’ll have the monthly EMI before your eyes.

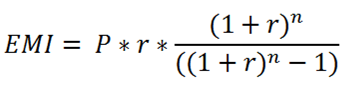

Here's the formula to calculate the Mortgage Calculator:

Where

E is EMI

P is Principal Loan Amount

N Number of years

R Monthly interest rate

For example : you avail a loan of INR 10 lakh with an interest rate of 12% for five years, so here’s how you will calculate your EMI. P = 10 lakh, R = 11/100/12 (You convert to months), N = 5 years or 60 months.

EMI = ₹10,00,000 * 11/100/12 * (1+11/100/12)60 / (1+11/100/1260 - 1)

= ₹22,244

How to use the Mortgage EMI Calculator?

- Use the slider for selecting the loan amount.

- Select the tenure of the loan in months.

- Move the slider and select for selecting the interest rate.

- The calculator will show you the EMI payable, Total interest, and Total Payable Amount.

- You can easily recalculate your EMI anytime all you need to do is change the input sliders accordingly.

- EMI will be calculated instantly when you move your sliders.

Benefits of Mortgage Loan Calculator

A Mortgage Loan Calculator helps you accurately make complex calculations super easy. Here are a few advantages of the Mortgage Loan Calculator:

- It is fast - It helps you with swift calculations.

- It is accurate - These calculators work on algorithms due to which there is a very less possibility of error.

- It’s free and unlimited - As this tool is free, you can use it whenever you like. Plus, as you are able to calculate your EMIs in advance, you can choose the best suitable plan/option for yourself.

Frequently Asked Questions

-

What is a Mortgage or a Loan Against Property Calculator?It is a tool that helps you accurately calculate your monthly installments for the repayment of your loan against your property.

-

Is the Mortgage Calculator easy to use?Yes, the Mortgage Calculator is super easy to use. All you have to do is enter the values in the slider and let the software do the rest for you.

-

Does the Mortgage Calculator show you the loan repayment schedule?This tool shows you the monthly EMIs on your loan against property. It also gives you an idea of the principal along with the interest amount, thus giving you a clear picture of your repayments and also the outstanding amount.

-

Will the bank check my credit score when sanctioning my loan against property?Yes, the bank will check your credit score before it sanctions your loan. Thus, it is very important to maintain a good credit score before you even approach a bank for getting a loan against property. However, if you are securing the loan against collateral property then it may sanction your loan for a lesser credit score as well.

-

Is Mortgage Calculator the same as the EMI calculator?No, a Mortgage Calculator is particularly designed to help you calculate your EMIs against property and the interest which you would incur on your loan.