Recurring Deposit Calculator

If you are one who believes in making regular monthly investments and earn interests, then opening a recurring deposit would be a wise choice. The investor while investing in a recurring deposit can choose the tenure and number of monthly deposits as per his or her convenience. The recurring deposit scheme is more flexible than FD schemes and generally preferred for those who want to build an emergency, or you can say a rainy-day fund.

Benefits of Recurring Deposit

- The Recurring deposit can be used as collateral for taking loans. You can take up to 80-90% loans on RD amount.

- RD schemes also allowed premature withdrawal deposits charging no or a minimal penalty

- The minors are also eligible to get themselves enroll in the RD scheme under the guardianship of parents

- The Tenure of the recurring deposit scheme ranges from 7 days to 10 years.

- The Recurring deposit allows you to save money on a regular basis and the minimum deposit amount can be as low as Rs 10

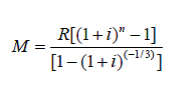

Here's the formula to calculate the Recurring Deposit:

Where

M is Maturity Value

R is Monthly Installment

n Number of quarters

I Rate of interest/400

For example : if you invest in RD and put in Rs. 5,000 per month for a year, at the interest rate of 8%, your total value will be calculated as:

R = 5000 n = 4 (one year has four quarters)

I = 8.00/400 M = Rs. 62, 647 in one year

How Online RD calculator works?

- Use the slider for the selecting monthly amount

- Tenure in months using slider

- Move slider and select the interest rate

- You can also retry the RD calculator by changing the input sliders

- The RD amount is calculated instantaneously when you move the sliders

Know about the benefits of using RD Calculator while investing in the RD scheme

RD calculator is a financial calculator that helps you in choosing the best recurring deposit scheme. Using this calculator, you can calculate the maturity and interest amount you can earn on your recurring deposit investment.

Benefits of using RD calculator

- You can save time and effort using the complex RD calculation formula

- The RD calculator can save you time and effort and deliver you results quickly

- This RD calculator is accurate and free from errors

- You can plan your finances well in advance.

- It's free of cost

Frequently Asked Questions

-

What is Recurring Deposit Calculator?The Recurring Deposit calculator helps you in calculating the return on investments. They take into factors the tenure, interest rate, and principal amount to find out results.

-

What are the benefits of recurring deposit calculator?The major benefits of recurring deposit calculator:

- Calculate returns on investment more accurately.

- One can use unlimited number of times, online RD calculator. Its free of cost

- Helps you in planning your finances well in advance

- Saves time and effort

- Cost effective

-

How is the RD amount calculated?The formula used in calculating RD amount is A = P(1+r/n) ^ nt, where 'A' represents final amount procured, 'P' represents principal, 'r' represents annual interest rate, 'n' represents the number of times that interest has been compounded, 't' represents the tenure.

-

What is the difference between Recurring Deposit and Fixed Deposit?

Recurring Deposit Fixed Deposit A recurring deposit investment scheme is basically investing small amounts monthly at a fixed interest rate A Fixed deposit is a one-time investment plan that allows to invest a lumpsum amount -

Can I withdraw my recurring deposit at times of financial emergencies?A recurring deposit works similarly like fixed deposit, once the RD amount is deposited, you can withdraw it partially but may have to lose some interest amount as a penalty.