Systematic Investment Plan Calculator

The SIP Calculator is a simple financial tool that helps in choosing the right SIP investment plan. All you are required for using the SIP calculator is invested amount, expected rate of return, investment tenure, and step-up rate. SIP calculators share the result mainly in two formats, chat format and graphic format representing potential gains, maturity amount, and investment amount.

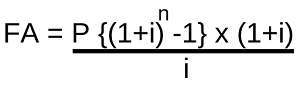

Here's the formula to calculate the SIP Calculator:

Where

FA is Future Amount

P is Principal invested each month

n Number of contributions towards the principal

r Expected Return Rate

For example : For planning your child’s higher education, you need 20 Lakhs after 5 years, if you invest 20,000 each month in SIP, and expect a rate of return of 12 percent per annum. The same amount if you put in the calculator:

Expected Gains- 4.5 Lakhs Future value – 16.5 Lakhs

So, the SIP calculator offers you information about returns expected and not guaranteed. SIP calculator is your go-to tool.

Approach followed by SIP Calculator

The SIP calculator works on the targeted amount approach and investment amount approach. The investment amount approach is considered when the investor inputs the amount of investment, return expected, step-up amount, and tenure. Whereas the targeted amount approach is adopted by an investor to set its target for the defined tenure and analyze the current investment required.

SIP calculator never shares accuracy, it only gives an estimate based on inputs provided. The SIP Calculator doesn’t guarantee fixed returns. The actual return on mutual funds depends on the performance of the fund. It may go higher or lower than estimates shared by the SIP calculator.

Types of Systematic Investment Plan Calculator

-

Flexible SIP :-

- This offers you the flexibility to make changes in the SIP amount.

-

Step-up SIP :-

- This SIP also known as top-up SIP, will increase your SIP investment amounts at fixed intervals.

-

Perpetual SIP :-

- It is an investment that continues indefinitely, having no defined tenure and end date to your SIP plan.

-

Trigger SIP :-

- It is an investment plan that functions based on certain trigger events. For instance, an investor triggers that your SIP should be doubled if the NAV of the scheme falls to a certain level.

Benefits of SIP Calculator

The SIP investment Calculator overcome problems and provides following benefits to investors!

-

Immediate results :

- Knowing the future value of your SIP investment has never been easier. It’s all possible through the SIP calculator. Offers immediate and correct results based on your inputs every time.

-

Easy to understand and use :

- The SIP calculator is easy to use, you don’t need to be a math whiz. It is also free of cost, online there are many websites available that offer you a free SIP calculator.

-

Helps you in making informed investment decisions :

- If you are making a SIP investment to achieve a specific financial goal, must use a SIP calculator. It will be a huge help in your financial guidance.

-

Helps you in adjusting your results according to inflation :

- Other financial calculators only offer you the future value of investments or monthly investment amount but here you will get inflation-adjusted results for your investment goals.

For example : if you want to calculate the FV for a SIP with ₹2,000 monthly contributions for two years and an expected rate of return of 12%, this is what the formula would look like for you:

FV = 2000 x {[(1 + 0.01)24 – 1] ÷ 0.01} x (1 + 0.01)

Note that the r is 0.01 since our expected rate of return is 12% per annum, which translates to 1% per month.

Frequently Asked Questions

-

What is NAV in SIP?In SIP, NAV is net asset value, in simple language, it is the cost that is taken into consideration when investors purchases or sell mutual funds units. The net asset value of SIP is updated after the business hours

-

How the SIP risk is determinedThere are mainly 4 types of risk associated with SIP:

- Risk 1 : The risk of SIP getting a negative return on price risk

- Risk 2 : The risk of being able to get your money back quickly or liquidity risk.

- Risk 3 : The risk of downgrade of a security related or credit risk

- Risk 4 : The risk of company not paying to bond owners

-

Which is better SIP or FD?Both are good to go investment schemes, you can choose any of them based on your financial goals. Each investment scheme has its own benefits. The returns in SIP and mutual fund is more as compared to FD.

-

How can SIP calculator help you?SIP calculator is one of the best financial guides for analyzing three financial figures- Principal, returns on the principal, and the future value. It gives you the financial idea that how much will be the return on investment. All is possible with SIP calculator online.

-

How accurate is online SIP CalculatorIt helps in computation of total value of investment, one is likely to get when SIP maturity tenure gets over. Yes, it shows accurate results and save your time and effort.