PAN Card Cancellation

According to Section 139 A of the Income Tax Act of India, an individual can apply for only one card for the entire life. No one is allowed to keep two PAN card numbers, in case, it is found, a penalty charge of Rs 10,000 will be levied by the Income Tax department of India. To avoid paying any penalty, here we have explained the whole procedure of PAN Card cancellation.

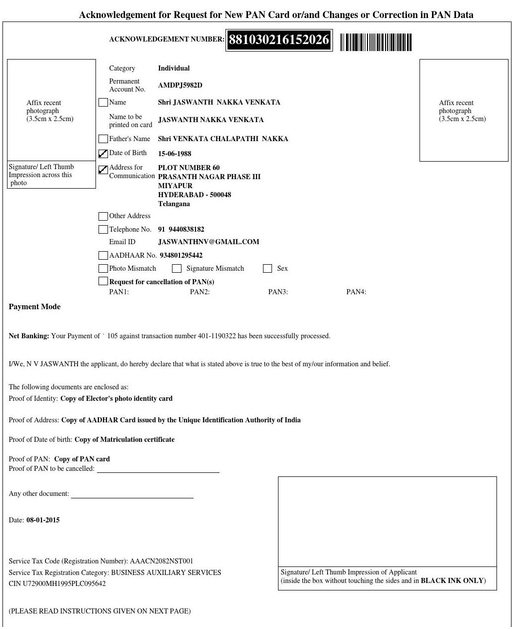

PAN Card Cancellation Form

Reason for PAN Card Cancellation

- If the applicant is having more than one PAN Card, he or she is required to go through the procedure of PAN Card cancellation

- The Income Tax Department due to some human errors allot the different PAN Numbers to the same individual by an IT Department. At that time, the PAN Card assessee ends up applying for a PAN Number multiple times

- Sometimes PAN Card allotted to an individual consists of some erroneous details. In that case, the individual is required to go through with the PAN card cancellation.

Ways to Cancel the PAN Card

There are mainly two ways to do PAN Card cancellation

Online mode of PAN Card cancellation

It is one of the quickest ways to make PAN Card cancellation. Here are the steps to follow

- Log on to the official website of TIN-NSDL

- Choose the option of Change or correction in the PAN Data section

- Select the category: Individual, Company, Partnership, or NRI

- Provide all the personal details like name, date of birth, address, both PAN Card details, etc. Make sure that the details provided are accurate.

- After mentioning the required information, click on to continue the PAN application form.

- Attached the scanned documents along with the e-sign. You can also submit the documents as per e-KYC as per your Aadhaar Card.

- PAN Card correction fee applied is Rs 107 for Indian citizens and Rs 994 for overseas citizens.

- Payment can be done through Cheque or DD in favor of NSDL or you can also pay the amount through credit card, debit card, or net banking.

- Enter your payment details and click on submit.

- Once the payment is done a new page will appear displaying your successful transaction details. Now you will ask to verify your Aadhar Card click the tick box and click on authenticate to proceed further.

- Once the authentication is completed click on Continue with e-Sign/e-KYC to generate the OTP. Enter the OTP that has come to your registered mobile number and click on submit.

- After submitting the Aadhar details now you will see a new page in which you can review your submitted application form.

- Download the application form, take a print-out and attach it with an envelope labeled under Application for PAN Cancellation with the acknowledgment number.

- Send it to the below address along with the relevant documents and two passport size photographs. NSDL e-Gov at ‘Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016

Offline procedure to cancel PAN Card

- Write an application to the Assessing officer of the concerned jurisdiction to cancel the PAN Card.

- Fill in the details on your application like the name of the applicant, address of the applicant details of the additional PAN Card which could be surrendered or canceled

- Details of the PAN Card that the applicant wants to keep

- Applicant must hold a copy of the acknowledgment number; this is proof that the applicant has successfully applied for Pan Cancellation.

How to check the PAN Card cancellation status

- Log on to the website of the Income Tax Department of India

- Click on Know Your TAN/AO, which is located in the left bar of the homepage .

- Choose the state and category of the PAN Card as mentioned on your name, mobile number and click on submit.

- On the next page, you will be able to see the status of your Pan Cancellation request.

Pan Card

-

Duplicate Pan Card

-

Pan Form 61

-

Chang of name Pancard after Marriage

-

Pan-Card-with-Paytm-Payment-Bank

-

Surrender-your-Pan-Card

-

Lost Pan Card

-

Pan Card for HRA Exemption

-

Bulk Pan Verification

-

Pan form 49A

-

Pan Form 49AA

-

What is form 60

-

What is Form 61A

-

How to Apply Pan Card

-

Pan Card Postal Address

-

Change Photo and signature in Pan Card

-

How-to-Check-TDS-Status-via-Pan Card

-

Get-Pan-Card-in-48-Hours

-

Get-Pan-Card-Through-Aadhaar-Card

-

Link-Pan-Card-with-Aadhaar-Card

-

Link Pan Card With EPF Account

-

how-to-track pan card Delivery Status

-

Pan-Card application for students

-

Pan-Card-Ackowledgement-Number

-

Change your pan address

-

Cancel Your Pan-card

-

Pan Card Corrections

-

Pan Card Charges

-

Pan Card for Minors

-

Pan card for NRI

-

Pan Card For Partnership Firms

-

Pan Card Jurisdiction

-

Pancard-Penalty

-

Pan Card reason for rejections

-

Required document for Pancard

-

Significance-of-Pan-kyc

-

Get Pan Card Details

-

What is Pan Card