How to link PAN card with Aadhaar Card

At the time of presenting Union Budget 2019, the Finance Minister had shared a proposal of mentioning the Aadhaar Card for filing Income Tax Return in India. It is only possible when we link PAN Card with Aadhaar Card. Almost 120 Crore Indians have now Aadhar Card.

It is a verified 12 digit number issued by the Unique Identification Authority of India. It acts as identity proof and residence proof. On the other hand, PAN is a permanent account number issued by the Income Tax Department of India under the supervision of the Central Board of Direct Tax.

According to Section 139 AA(2) of the Income Tax Act, every person having PAN as of July 1, 2017, has to link to Aadhaar Card also.

Benefits of linking PAN Card with Aadhaar Card

- Pan Card linking with Aadhaar Card makes the procedure of filing an Income Tax a simplified one. An individual with the linking of PAN and Aadhaar can do a digital signature rather than going for a physical signature.

- One can easily go for an online bank account opening

- Easy authentication of tax filings their filings through the Aadhaar Card itself.

- An individual can do glancing all the transactions through Income Tax Login

- Linking of PAN and Aadhar Card makes it easier for the government also to track the financial or taxable transactions of a citizen of India.

Ways to link PAN Card with Aadhaar Card

- Through the Income Tax e-filing website

- By sending SMS

- By filling up the form

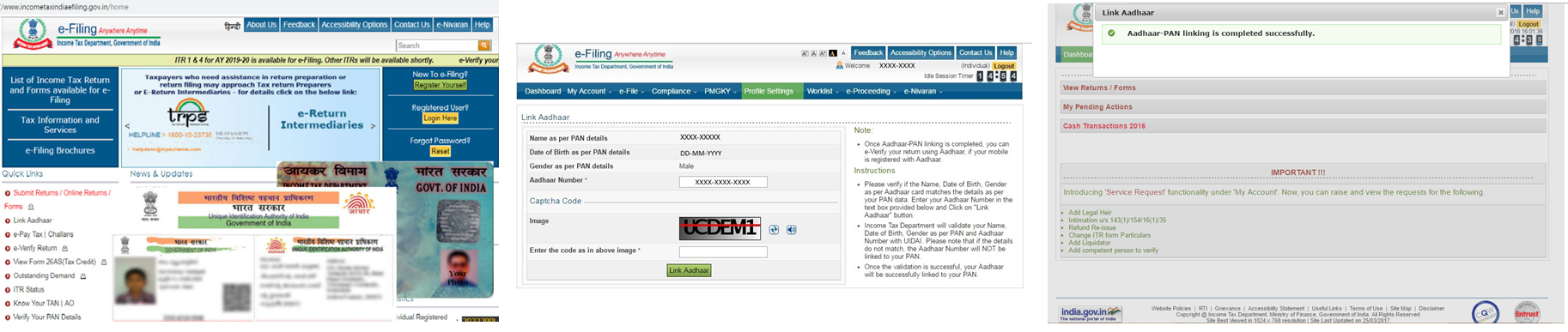

Steps to link PAN and Aadhaar Card using Income Tax e-filing website

- Log on to the website of Income Tax e-filing.

- Click on the sub-option Link 'Aadhaar' below the option 'Quick Links.'

- Enter the Aadhaar details and PAN details and your name

- Enter the Captcha Code and click on the link’ Aadhaar Option’.

- A pop-up message will appear that 'Your Aadhaar will be successfully linked with your PAN.'

Steps to link Aadhaar Card with PAN Card using SMS

- An individual can link PAN Card with Aadhaar card by sending an SMS in a format UIDPAN 12 Digit Aadhaar10 Digit PAN .

- Send the message to either 567678 or 56161 from your registered mobile number.

- If the information provided is correct, the Aadhar will be linked to PAN successfully.

Offline procedure to link PAN with Aadhaar Card

If individuals are willing to link manually PAN with Aadhaar? The individual needs to visit the nearest NSDL center and fill in PAN application for with relevant documents.

What is the procedure to check the status of linking PAN with Aadhaar?

An individual can check whether his Aadhaar is linked with PAN or not. Steps to check are mentioned below

- Log on to the official website Income Tax E-filing website.

- Click on the sub-option to link Aadhaar

- A new screen will pop-up, with an option of ‘click here to view the status after submitting the Aadhaar request.

- Enter the details and click on ‘View Link Aadhaar Status’.

- You will get to know the status of Aadhaar and PAN card linking.

Know about the correction facility of linking PAN Card and Aadhaar Card

The correction facility launched by the Income Tax Department of India related to linking of PAN card and Aadhaar Card. Online it takes place easily. There are mainly two hyper links available on the website of e-filing of tax. One link will take you to the application page of PAN and other takes you to the page where you update all the necessary changes. If you are looking forward to update Aadhaar details, individual log on to the Aadhaar SSUP along with the uploading of all scanned documents.

How to correct the PAN details?

- Visit the NSDL website

- Click on the option’ Correction/ Update of PAN details’

- Attach the scanned documents to get your PAN details updated

- Once your details are updated in your PAN and confirmed by NSDL over a mail, you can link your PAN with Aadhaar

Pan Card

-

Duplicate Pan Card

-

Pan Form 61

-

Chang of name Pancard after Marriage

-

Pan-Card-with-Paytm-Payment-Bank

-

Surrender-your-Pan-Card

-

Lost Pan Card

-

Pan Card for HRA Exemption

-

Bulk Pan Verification

-

Pan form 49A

-

Pan Form 49AA

-

What is form 60

-

What is Form 61A

-

How to Apply Pan Card

-

Pan Card Postal Address

-

Change Photo and signature in Pan Card

-

How-to-Check-TDS-Status-via-Pan Card

-

Get-Pan-Card-in-48-Hours

-

Get-Pan-Card-Through-Aadhaar-Card

-

Link-Pan-Card-with-Aadhaar-Card

-

Link Pan Card With EPF Account

-

how-to-track pan card Delivery Status

-

Pan-Card application for students

-

Pan-Card-Ackowledgement-Number

-

Change your pan address

-

Cancel Your Pan-card

-

Pan Card Corrections

-

Pan Card Charges

-

Pan Card for Minors

-

Pan card for NRI

-

Pan Card For Partnership Firms

-

Pan Card Jurisdiction

-

Pancard-Penalty

-

Pan Card reason for rejections

-

Required document for Pancard

-

Significance-of-Pan-kyc

-

Get Pan Card Details

-

What is Pan Card