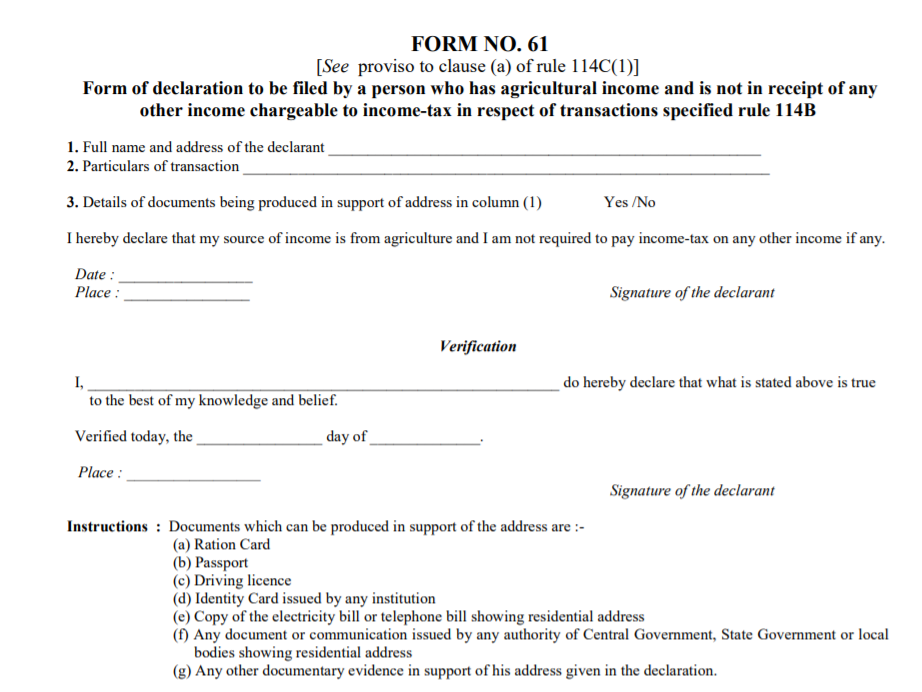

Form 61

It is a document that acts as a declaration that all information given in Form 60 is accurate. This form is a way to share basic details like applicant name, transaction particulars, self-attested copy of documents duly signed and attached by the applicant. This form is mandated to submit by all those individuals who are earning an agricultural income or in any or from any employment and who do not earn any other income taxable unless inferred from the transaction mentioned in the a-h clauses under the law of 114b. This Form is provided by the Income Tax Department of India as per the directions of the Central Board of Direct Taxes.

What is the significance of Form 61?

Where filing Form 61 is important?

- When making any deposits with the bank worth Rs 50,000 or above.

- When making any deposit with the Post office worth Rs 50,000 or above.

- Making sale or purchase of the property worth Rs 5 Lakh or above.

- Making sale or purchase of a vehicle excluding 2 wheelers.

- When anyone opens a new bank account.

- Selling or purchase of securities exceeding 10 Lakh

- Applying for a new credit card or debit card

- Opening of Demat account

- Buying of securities or bonds worth Rs 50,000 or above

- Paying a life insurance premium for the amount exceeding Rs 50,000 in a financial year

- Trading in securities worth Rs 1000,00 per transaction

What are the documents required to fill Form 61?

- Driving License

- Aadhaar Card

- Voter ID Card

- Utility bills of last 3 months

- Ration Card

- Passport

- The document having the residential address of the claimant issued by the State or Central Government

Online procedure of submitting Form 61

The online procedure of applying for Form 61 is simplified. All an applicant is required to log on to the e-filing portal after generating ITDREIN (Income Tax Department Reporting Entity Identification Number).

ITDREIN is a 16 character identification number in the format XXXXXXXXXX.YZNNN where: XXXXXXXXXX stands for PAN/TAN of the reporting entity. Y stands for the code of Form code Z- Code of reporting entity category for Form code. NNN- Code of the sequence number.

The offline procedure of submitting Form 61

Download the form from the portal of the Income Tax Department of India.

Provide the details like

- Residential address of the applicant

- Date of birth

- Father's name

- Valid mobile number Details

- Amount of the transaction details of the application

- Acknowledgment number of PAN if not received by the applicant

- The applicant has to sign in the verification mentioned in the form and declare that the given information is correct to the best of their knowledge.

Hand out Form 61 to the concerned person handling the transactions.

Difference between Form 60 and Form 61

Form 60 is an official document issued by the Income Tax Department of India to all those individuals who do have a PAN Card but willing to enter into any financial transaction according to Rule 114B.

Form 61

It should not be submitted by an individual who is earning agricultural income or from any employment and who does not earn any kind of income taxable. It is mandated for all agricultural income holders to submit Form 61 under rule 114B.

Pan Card

-

Duplicate Pan Card

-

Pan Form 61

-

Chang of name Pancard after Marriage

-

Pan-Card-with-Paytm-Payment-Bank

-

Surrender-your-Pan-Card

-

Lost Pan Card

-

Pan Card for HRA Exemption

-

Bulk Pan Verification

-

Pan form 49A

-

Pan Form 49AA

-

What is form 60

-

What is Form 61A

-

How to Apply Pan Card

-

Pan Card Postal Address

-

Change Photo and signature in Pan Card

-

How-to-Check-TDS-Status-via-Pan Card

-

Get-Pan-Card-in-48-Hours

-

Get-Pan-Card-Through-Aadhaar-Card

-

Link-Pan-Card-with-Aadhaar-Card

-

Link Pan Card With EPF Account

-

how-to-track pan card Delivery Status

-

Pan-Card application for students

-

Pan-Card-Ackowledgement-Number

-

Change your pan address

-

Cancel Your Pan-card

-

Pan Card Corrections

-

Pan Card Charges

-

Pan Card for Minors

-

Pan card for NRI

-

Pan Card For Partnership Firms

-

Pan Card Jurisdiction

-

Pancard-Penalty

-

Pan Card reason for rejections

-

Required document for Pancard

-

Significance-of-Pan-kyc

-

Get Pan Card Details

-

What is Pan Card