How to Link PAN Card with EPF Account

The government has made it a compulsion of linking PAN Card with EPF account. By updating the KYC details, users can easily do a linking of PAN Card with EPF account.

Here are steps for online linking of PAN Card with EPF account.

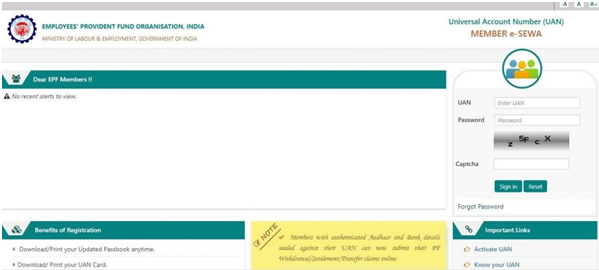

Log on to the website of EPFO e-Seva portal. Please remember that the username is your UAN number. You can set your password with the help of the same.

After entering the username and password. You are required to give the Captcha Code to sign in.

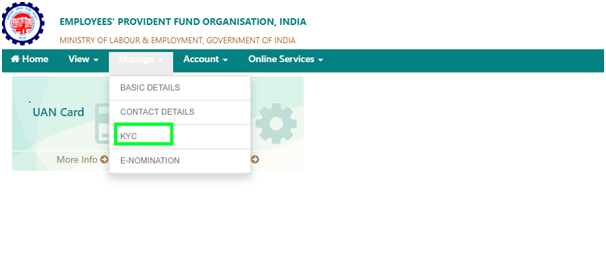

After that, it will redirect to you on a homepage, click on the ‘ manage tab’ and under the tab, choose the KYC option.

It will redirect the user to a new page where one can add the KYC details After that click on the ‘ Document Type Tab’ to understand

Select the option ‘PAN’ from the list and enter the PAN details and full name to proceed further.

Next, users should click on the Save button

If the details mentioned in your EPFO account match with PAN, it would get verified automatically Post the verification, the PAN account gets linked with the EPF account.

The change will reflect in your ‘ Member Profile Tab ’ that is visible on your EPF account home page.

For claiming EPF, it is a must to link a PAN card with an EPF account. In case your claim exceeds INR 50,000, you become liable to pay TDS at 35%, wherein the regular rate after linking is 10%.

Offline procedure of linking PAN Card with EPF Account

- An individual is required to visit the EPFO office to complete the EPF-PAN linking procedure.

- Duly fill in the form and provide PAN details, UAN number, and full name.

- Users are required to submit the self-attested copy of their UAN and PAN Card.

- After verification documents are submitted, your PAN card and EPF Account will be linked. Once the process is complete, you get a notification of the same on your registered mobile number.

- In case the details on your PAN card and EPF account will not match, you will need to get either of them updated. If the request gets rejected even after all details matching, you may complain to the EPFO authorities online. by visiting this link.

Pan Card

-

Duplicate Pan Card

-

Pan Form 61

-

Chang of name Pancard after Marriage

-

Pan-Card-with-Paytm-Payment-Bank

-

Surrender-your-Pan-Card

-

Lost Pan Card

-

Pan Card for HRA Exemption

-

Bulk Pan Verification

-

Pan form 49A

-

Pan Form 49AA

-

What is form 60

-

What is Form 61A

-

How to Apply Pan Card

-

Pan Card Postal Address

-

Change Photo and signature in Pan Card

-

How-to-Check-TDS-Status-via-Pan Card

-

Get-Pan-Card-in-48-Hours

-

Get-Pan-Card-Through-Aadhaar-Card

-

Link-Pan-Card-with-Aadhaar-Card

-

Link Pan Card With EPF Account

-

how-to-track pan card Delivery Status

-

Pan-Card application for students

-

Pan-Card-Ackowledgement-Number

-

Change your pan address

-

Cancel Your Pan-card

-

Pan Card Corrections

-

Pan Card Charges

-

Pan Card for Minors

-

Pan card for NRI

-

Pan Card For Partnership Firms

-

Pan Card Jurisdiction

-

Pancard-Penalty

-

Pan Card reason for rejections

-

Required document for Pancard

-

Significance-of-Pan-kyc

-

Get Pan Card Details

-

What is Pan Card