PAN Card Jurisdiction

The Permanent Account Number is a 10-digit unique alphanumeric code allotted to all the taxpayers of India. Each PAN Cardholder connected with the Assessing officer who belongs near to their residential address. These are known as Assessing officer codes which denotes the following

If you are thinking, where to know about your PAN jurisdiction, no need to worry, here at our platform you can check your PAN jurisdiction, we will give you the full jurisdictional details on entering the PAN Number.

What is the importance of PAN Jurisdiction?

Knowing about PAN Jurisdiction means getting full-fledged information regarding the Chief commission region, Joint Commissioner Range, designation, and place of the assessing officer. Let’s take an example, suppose you have filed an application for PAN Card by the Income Tax Department of India, based on the permanent address, you can easily check PAN Card status.

In case you have changed your residential address and want to update the same on the PAN Card. In that case, it is a must to change the PAN jurisdiction, which lies with the jurisdictional Assessing Officer allotted to be assessed when applied for a PAN card.

Here comes the importance of knowing about the PAN jurisdiction. It makes it easier to update the address on your PAN Card. Individuals can know their PAN Details by visiting the official website of the Income Tax Department.

In what scenarios one has to change the PAN Jurisdiction?

Individuals can change their PAN jurisdiction in case of the following scenarios.

Changing AO due to Unsatisfactory Behavior

- Write an application to Income Tax Ombudsman

- Share all details like name, address, and the name of the Assessing officer along with citing the reasons for to change of PAN jurisdiction.

- The ombudsman needs to sign on your application to approve the same.

- Along with the application it is mandated to furnish relevant supporting documents.

- Once approved, the application is forwarded to the Income Tax Commissioner

- On his approval, the present AO is changed to a new Assessing Officer

Here is the procedure to know about the PAN Jurisdiction

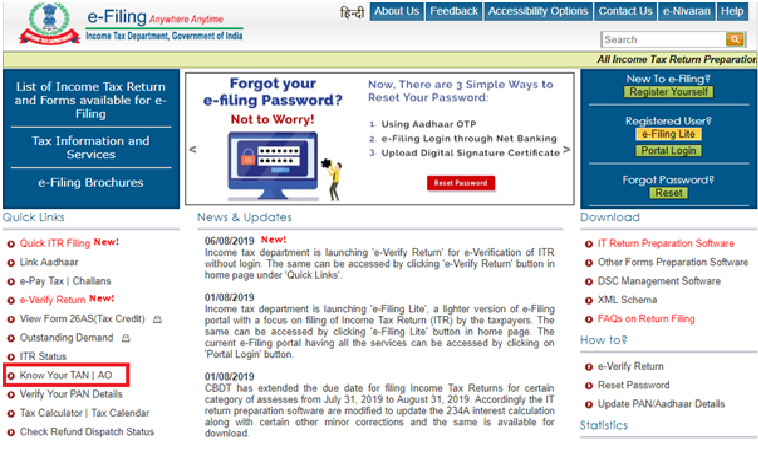

Log on to the official website of the Income Tax Department of India .

Click on the option AO from “Know Your TAN|AO”

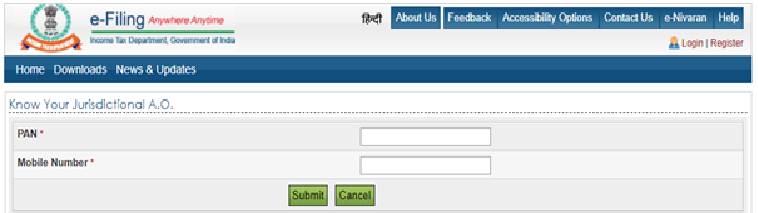

Provide details like PAN and ‘ Mobile Number’ and then click on the ‘submit’.

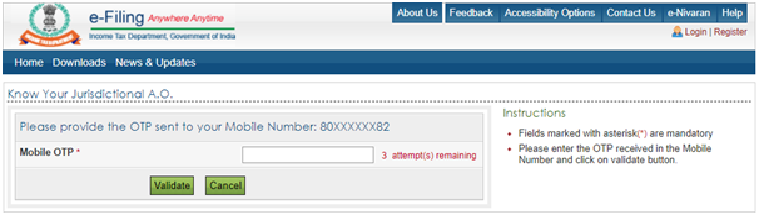

Enter the OTP on the mentioned space. This OTP you will receive on your registered mobile number and click “Submit”.

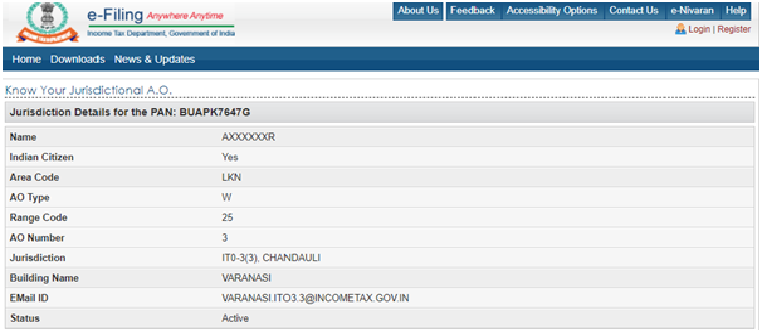

You will get to know about PAN jurisdictional details. It will be displayed on the screen for the concerned PAN number.

Steps to follow for change of Assessing Officer at the time of change of address:

- When the Assessee is changing his or her residential address, he or she has to communicate the same to the Income Tax Department of India. The easiest way of communicating the same is to update the changes in your PAN data. Here are the steps to follow for making changes of Assessing officer:

- Write an application of address change to the at present Assessing officer. Make sure the reason for the change of address is mentioned.

- After that, write another application to the new Assessing officer and request him or her to ask the existing AO to make a change in PAN jurisdiction.

- The current AO has to accept the AO change application if the reason is valid and satisfactory.

- Once approved, the application is forwarded to the Income Tax Commissioner

- After getting approval from the commissioner, the AO is changed from the existing AO to the AO from where the application process was initiated

- In case the existing AO rejects the application request, the migration of PAN will not move forward, and the migration gets stuck. The new AO can do nothing to get the application approved.

Pan Card

-

Duplicate Pan Card

-

Pan Form 61

-

Chang of name Pancard after Marriage

-

Pan-Card-with-Paytm-Payment-Bank

-

Surrender-your-Pan-Card

-

Lost Pan Card

-

Pan Card for HRA Exemption

-

Bulk Pan Verification

-

Pan form 49A

-

Pan Form 49AA

-

What is form 60

-

What is Form 61A

-

How to Apply Pan Card

-

Pan Card Postal Address

-

Change Photo and signature in Pan Card

-

How-to-Check-TDS-Status-via-Pan Card

-

Get-Pan-Card-in-48-Hours

-

Get-Pan-Card-Through-Aadhaar-Card

-

Link-Pan-Card-with-Aadhaar-Card

-

Link Pan Card With EPF Account

-

how-to-track pan card Delivery Status

-

Pan-Card application for students

-

Pan-Card-Ackowledgement-Number

-

Change your pan address

-

Cancel Your Pan-card

-

Pan Card Corrections

-

Pan Card Charges

-

Pan Card for Minors

-

Pan card for NRI

-

Pan Card For Partnership Firms

-

Pan Card Jurisdiction

-

Pancard-Penalty

-

Pan Card reason for rejections

-

Required document for Pancard

-

Significance-of-Pan-kyc

-

Get Pan Card Details

-

What is Pan Card